Us Notes And Coins Worth Far More Than Their Face Value

Content

- Our Guide To The Valuable Coins That Can Turn Up In Your Change

- Coining It In

- What Have We Been Doing To Support The Economy ..

- Who Monitors Whether We Provide Value For Money

- Gold V Paper Money: Which Should We Trust More?

In 1200 BC, the money system becomes slightly more sophisticated with the use of Cowrie or Cowry shells, although there was still an overlap of bartering going on. Around 1000 BC the first base metal coins come on the scene and set the tone for money exchange into the future. The most interesting feature of the political economy of LETS is the relationship between these exchange circuits and the system of public finance in the wider economy . At times officials have taken the hard line that all LETS transactions constitute normal income, to be deducted from eligibility for benefits and added to income tax liabilities.In 2015 the US Commodity Futures Trading Commission officially designated Bitcoin as a commodity, yet Bitcoin doesn’t neatly fit into either category and instead may be a mix of both. The way Bitcoin is traded today is akin the way gold and silver originally circulated both as a valuable physical good and as direct payment. Although 31 billion sounds a lot, in the grand scheme of things this is very little. The total value of gold reserves is estimated to exceed $7 trillion alone.Far from being the product of intermittent and isolated encounters between savages, this was a lucrative trade driven by a global mercantilism originating in England and France. Money was scarce on the frontier, but the exchange ratio of hides was calculated on the basis of known world prices back home.Anthropologists have paid more attention to non-market exchange and money in non-western cultures than to the operations of money in the capitalist heartlands. The collection on barter edited by Humphrey and Hugh-Jones is authoritative , while the Parry and Bloch collection on money in exotic cultures has the strengths and weaknesses of the genre . But now Chris Gregory has produced Savage Money, the first serious attempt to combine exotic ethnography with a feeling for modern world history. Thomas Crump’s The Phenomenon of Money is a speculative work by an anthropologist with a great interest in quantification. Mary Douglas has written about money as originally as any anthropologist. When it comes to the history of economic ideas, I rely on Schumpeter’s History of Economic Analysis as a work of reference .There are some coins that were once relatively common but are no longer in circulation. Since 1997 many people have snapped up a £2 coin with a portrait of the Queen wearing a necklace, believing it to be rare. However, it won’t turn up in your change without you realising as they are no longer used. They are one of the chunkier 50p coins replaced by the slimmer model in 1997. The coin illustrates a table with 12 stars representing the capital city of each member nation at the time. It is the first time a fictional character has been printed on a coin and they are fast disappearing from circulation because collectors are hoarding them. With a total of 417 million £2 coins in circulation, they are not easy to come by and typically sell online for around £20.Average deposits of £2,000 and loans of £8,000 suggest that the bank appeals to people of middle income. The scale of operations is significantly larger than any LETS scheme. Ithaca, like much of upstate New York, has suffered economic decline in recent decades. For some of its inhabitants it seems as if the money has simply gone elsewhere. The idea of Ithaca hours is to keep more of it within the community by tying transactions to a closed circuit motivated by local interests.

Our Guide To The Valuable Coins That Can Turn Up In Your Change

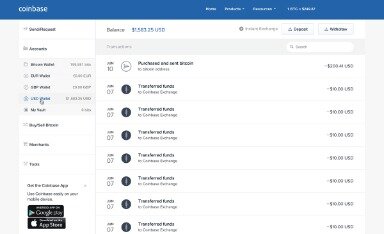

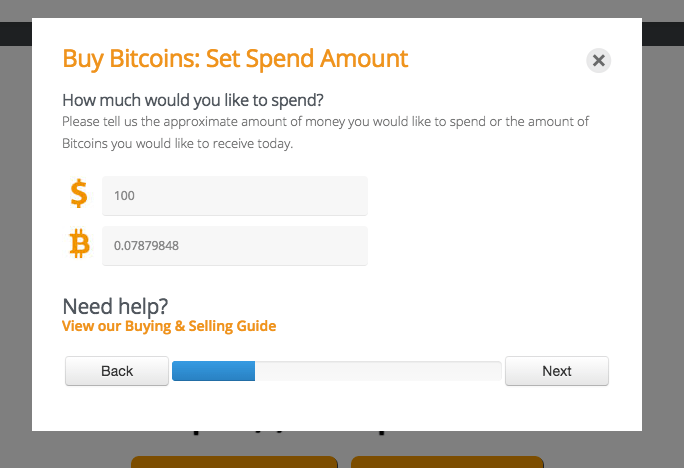

Credit cards allow customers to pay for items before the money actually leaves their account. money which means that it can’t be exchanged for just a single item. People accept this money in return for goods or services because they know that they themselves will be able to use it at a later date. This was paper notes which could only be exchanged for a particular item. In 1715, “tobacco notes” were issued in North Carolina, USA which could be exchanged only for a certain amount of tobacco. Later towards the end of the 19th century, gold and silver certificates were used in America.Since the new £1coin was launchedin March, hundreds of the 2016 coins have been listed on eBay. Similarly rare £2 coins with errors on them – such as one released in 2007 to mark the 200th anniversary of the 1807 Abolition Of The Slave Trade – have been offered on the auction site for £300. In recent weeks a number of “inverted effigy” Britannia £2 coins were sold eBay for between £77 and £100.Robin Blackburn is preparing a paper on what he calls “grey capitalism”, reflecting both the average age of the constituency he is interested in and the murky character of the property law involved. Over half the value of equities in the USA and Britain at this time are owned by pension funds and life insurance companies. What would be the result if contributors banded together under various identities to exert more concerted pressure on the managers? At present, the latter are protected by laws which ask of them only that they demonstrate reasonable caution in their investments. This accounts for the herd mentality of these people, since, as long as they do what everyone else does, they cannot be accused of professional mismanagement.

Coining It In

In this example, children are playing with blocks of paper money, showing that it is practically useless. Token money is related to the concept of fiat money – money which derives its value from government regulation or law. Token money is a form of money which represents a greater value than its intrinsic value. It’s absurd to think the government is actually in debt to the CB , denominated in money that the CB has the exclusive rights to make, with no upper limit on how much they can create. The problem with the economic orthodoxy is they think we are all rational actors.

We remember the rules we have been taught to abide by and these supersede the act of remembering for ourselves. Money may give expression to the child in each of us, by giving vent to our desires. But it is also one of the principal ways through which we learn as adults to participate in normal society.

What Have We Been Doing To Support The Economy ..

But coins and paper bills are only one form of money, called currency. Western Europe used a number of coins from many different authorities due to Feudalism, so there is no standard in shape, weight, and size, but after trading increased, that standardized.Anthropologists have consequently turned to investigating the material and political processes that create, regulate, and circulate money. This entry considers debates about what counts as money, and then addresses how money mediates social relations and identities. It next examines what happens when people manage multiple currencies, particularly when state-centric monopoly currencies unravel and monetary pluralism is on the rise.The average credit card debt of American households today is around $5,000, which hardly suggests uncontrolled spending. Moreover, consumers expand and contract their level of indebtedness in rhythms that are not understood by the economists, but clearly reflect their own collective determination of when they feel comfortable with debt and when they don’t. In countries like France, people have not yet been given the chance to explore the possibilities of plastic credit already enjoyed by their anglophone cousins. There banks in effect offer the facility of debit cards, where funds are drawn directly from checking accounts. Typically these limits are increased as the customer demonstrates creditworthiness.

Who Monitors Whether We Provide Value For Money

” is inevitably based on historical speculation, it does require us also to look at non-market exchange in the contemporary world, at exchange from which the medium of money is absent. And the impact of modern money and markets on societies which were until recently without them extends this enquiry into how to conceptualise the distinctive properties of exchanges based on money. But now centralised states are in disarray to a variable extent, even though their bureaucracies remain powerful. The word is out for devolution to less rigidly organised “communities” or regions.

- Credit cards allow customers to pay for items before the money actually leaves their account.

- They are thus well-positioned to investigate future monies, by asking how objects travel, generate prestige, and introduce new forms of inequalities.

- When it comes to the world of money itself, there are also some remarkable instances and future possibilities to report.

- Offshore banking can afford to offer interest rates on average one percent higher than those banks who are subject to national regulation, because of the reduced costs entailed in avoiding the necessity for deposits.

Most people can afford all the books that they need – an increase in money supply won’t lead them to buy more books. The only good example that I can think of is housing which is of course in very short supply. If you don’t think that saving money will allow you to buy a house there is indeed little incentive to save.As we have seen, the gold standard broke down between the two world wars; and it was replaced just over fifty years ago by the agreement known as Bretton Woods. This was a system of state-guaranteed money with fixed exchange rates tied to the main reserve currencies, especially the American dollar. In other words, international trade rested on confidence in the world’s strongest economy, the United States. Bretton Woods broke down in the early 1970s as a result of the convulsions in world commodity markets and associated shocks to national finances brought about by the first OPEC oil price increase. This led to a hesitant acceptance of a free market in money, a process which was accelerated by the development of markets dealing in money futures. These were invented in Chicago in 1975, partly on the initiative of the liberal economist, Milton Friedman, who wanted to teach governments the lesson that “they could not buck the markets”.The outline of the golden engraving is visible to the naked eye – but a microscope will be needed to see it properly. Tiny portraits of author Jane Austen were added to four of the new £5 notes by micro-engraver Graham Short – and if you’ve got one it could be worth £50,000, art experts say. If you invest in currencies other than your own, fluctuations in currency value will mean that the value of your investment will move independently of the underlying asset. When the pound falls in value, those dollar earnings buy more pounds when exchanged back into sterling, making those revenues more valuable.”The present system is a policy tool. It allows the central bank and by extension the state to manage the economy. It creates near-term booms but we pay for them with a big hangover at the end of the boom.” This volatility of gold prices means it is also risky for investors like Brian and Frances, who have large amounts of their personal savings tied up in gold investments – £40,000 of gold might be worth less a year down the line. She says that if the amount of money in the system was limited by pegging it to gold it would limit economic growth, which is the last thing we need right now.